What’s the gold standard for a discovery process? See our exemplary approach – BBUD

22 Nov 2023

We share our standards and explain the logic beneath to show you how we work (image by Midjourney)

Is there an optimal sequence of activities that leads to a successful discovery phase? Frankly – we don’t know. But we can share our standards and explain the logic beneath to show you how we work.

The beginning of any discovery process we undertake is like the beginning of a journey into the minds of our clients and users. This is the moment when needs, desires, and ideas become a reality and abstract goals take shape.

It is a complex process – and we always tailor it to individual needs and requirements. At the same time, we need a map of the steps we take to achieve the end result. It is like building a path between the client’s vision and the project's universe. It's about creating a common language and understanding that opens the doors for creative design and efficient development.

We have discussed in detail how to arrange these steps, plan a discovery process, and whether there’s one defined order. While we think it’s not the only correct answer, it can serve as an example and a backbone for further modifications.

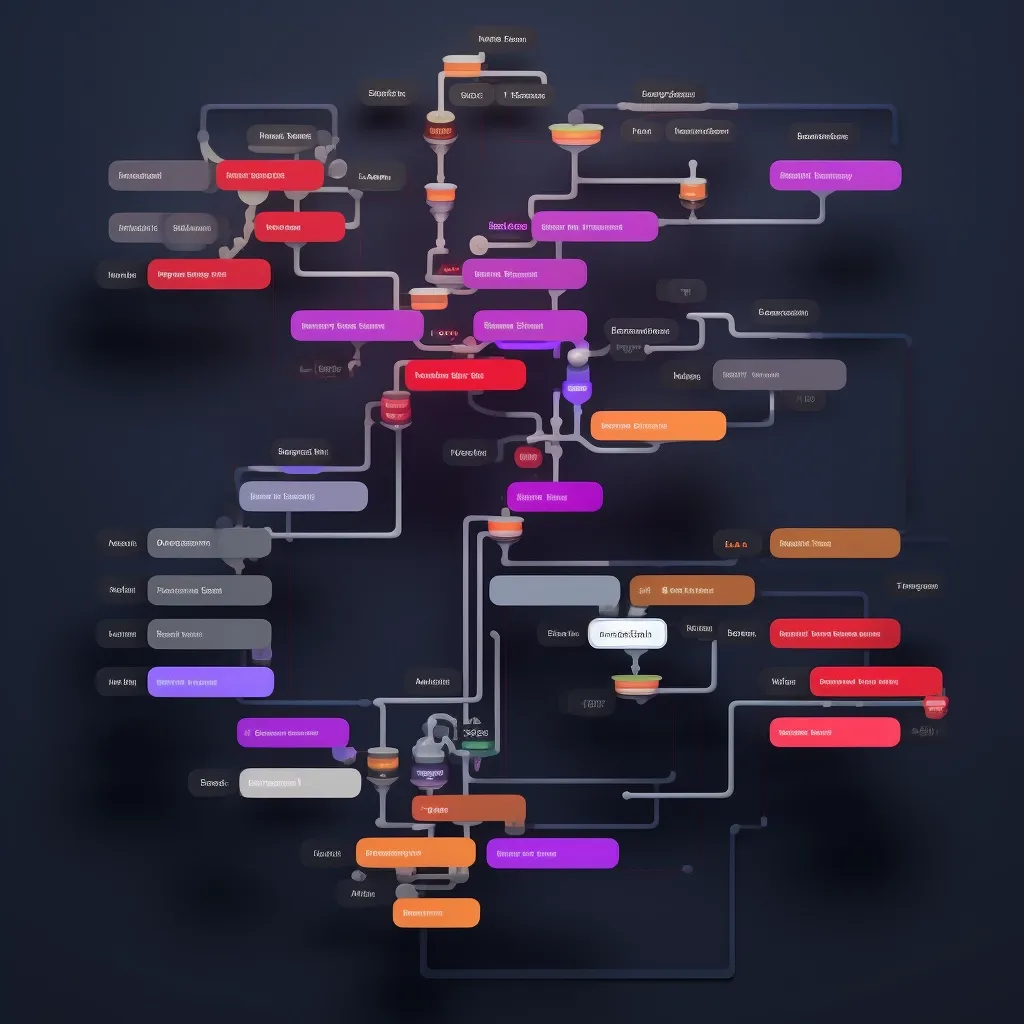

You can also take a look at the illustration that summarises the process at the end of this article.

Meet BBUD

We gave this sequence a working title, “BBUD” (Business I, Business II, User, Desk). It includes four main phases: in the first two, we interact with the business; in the third one, we focus on the user; and in the last one, we do desk research.

Why two phases for business? Phase I can be treated as the initial one – it sets the foundation by aligning the project with business goals and is mainly based on meetings. Phase II advances into detailed business exploration and involves actual discovery activities. Phase III is all about understanding end-user needs, and phase IV centres on desk research for data analysis. While these phases maintain their order, there's flexibility within each stage to adapt to project-specific nuances, ensuring an agile and responsive approach to developing effective and tailored solutions.

Read also: How do we conduct the discovery phase when working with a newsroom?

Our model can serve as an example and a backbone for further modifications (image by Midjourney).

Phase I: Business perspective. Setting the foundation for success

In the first phase of the discovery process, we want to get to know the client’s organisation and lay the foundation for a successful journey. To do this, we look at historical and future perspectives and how they align with today's strategy. We review previous change efforts, define project objectives and key performance indicators (KPIs), and evaluate documents. In addition, we focus on identifying critical processes involving users that are pivotal in shaping our future strategy. Together, these activities form the foundation for building a successful project.

1) Defining business strategy

- Learning historical and future perspectives around the designed solution

- Previous efforts towards change

Defining business strategy seems like an obvious task to do, but it’s a critical aspect of our collaboration with the client. It informs the trajectory of the product, ensuring that our project is firmly rooted in its historical origins and future aspirations.

Our experience shows that focusing too narrowly on the project solution might lead to overlooking the broader context. So, it’s essential to consider both past and future perspectives that could impact the project's direction.

This is to provide a holistic view that helps us spot potential intersections and learn from your past experiences, even if they didn't go as planned. It helps avoid making the same mistakes and potential conflicts with other projected solutions.

2) Setting the goals

- Defining project goals

- Establishing KPIs

For the success of any project, it is necessary to set clear and well-defined goals. They can give the project an overarching, qualitative direction. On the other hand, KPIs serve as measurable indicators that measure the extent to which objectives have been achieved.

For example, if the goal is to make the system user-friendly, this can be translated into a KPI by analysing user ratings. Success could be that more than 70% of users find the new system user-friendly, intuitive and easy to use, which is a clear and measurable benchmark for achieving the goal.

3) Key documents, processes and workflows

- Analysing materials and documents

- Identification of key processes for users

Exploring documents, processes, and workflows is not always a straightforward journey, as sometimes the information is scattered or arrives in stages, depending on the client's brief and the project's evolution. Materials we dig into include reports, presentations, previous research and analysis, sketches of previous solutions and anything else that has been produced and might be relevant to the project and enrich our knowledge.

Some materials are relevant at the early stage, while others become significant as the project advances – but familiarising ourselves with the documents, whether initially presented or over time, lays the foundation for establishing a common language. This process also aligns with identifying key processes and workflows to create a holistic view. It is also a good time to determine further steps.

Phase II. Business perspective. Setting the stage for advanced exploration

After gaining the preliminary knowledge, we get deeper into the project's core. We stay in the business perspective but come from words to action and prepare the setting for user research.

The second phase includes identifying potential project risks and preparing us to navigate challenges. We establish a common language to ensure seamless communication. Current product demos, insights into preferred technologies, and expert analysis of the client's digital products are next on the agenda. We also focus on business stakeholder identification and engage in interviews with the client, gaining a perspective to inform our approach furthe

1) Identifying project risks and opportunities

Identifying project risks helps us recognise potential factors that could impact the project's ultimate success or failure. This task goes beyond just listing what could go wrong; it involves working on the initiative’s chances and countermeasures for each potential roadblock.

The client’s engagement in this process is vital, though we understand that initiating these discussions can sometimes be challenging. However, it’s indispensable to lay the groundwork for a robust risk management strategy.

We also focus on business stakeholder identification and engage in interviews with the client (image by Midjourney)

2) Establishing a common language

It took us a while to decide where this point should go. Learning the client’s jargon can start at various points: at first meetings, during the documentation analysis, or during initial conversations. It also expands beyond one stage in the process – but we need some basics to start.

Establishing a common language and creating a glossary makes everyone involved comprehend the terminology and concepts employed by the organisation. It’s important for us to learn it, whether it’s industry-specific or unique to the company – we need to clarify many terms early on to prevent misunderstandings and misinterpretations.

We aim for a relatively high level of a common language. As different industries use the same terms with different meanings, we must be 100% sure we always mean the same things. Sometimes, we create a glossary together with the client’s team and follow up with additional questions in the interview stage.

3) Learning the products

- Current product demo

- Expert analysis of digital products

- Technologies in which your company works or wants to work

Knowing your company’s current product is an anchor point for our understanding of the project. This presentation may take different forms. It can be a self-guided app tour or a demo of more complex back-office products.

It often happens that, at the beginning, we interact with the product ourselves. We walk through it, we click, scrutinising every tab, process, and button. Sometimes, we opt for a guided demo or a combination of both approaches, especially with back-office products.

The timing of these demos can vary depending on the product's complexity – so we take a flexible approach.

4) Stakeholders discovery

- Business stakeholder identification

- Interviews with the client

Through interviews with business representatives, we foster connections with key people in the client’s organisation who influence the project. This process helps us understand the organisational dynamics and ensures that our solutions are aligned with the diverse needs of the client’s team.

This is also an opportunity to ask questions that have come up in earlier stages, such as demo or glossary building. We may want to know how something works or what something means.

Of course, this is not the only interview we conduct – but it is still important to lay the groundwork before we move on to the next phase.

Read also: The power of UX ethnographic research in a newsroom

Phase III. User-centric insights

In this phase, we delve into comprehensive user research, employing various methods such as analysis of existing user research, web analytics, in-depth interviews (IDIs), user surveys, group workshops, ethnographic research, and analysis of user session recordings. Our primary goal during this section is to gather data and insights that paint a holistic picture of the user's needs, behaviours, and pain points.

1) Analysis of existing user research

This step lets us learn more about our users’ demographics, behaviours, preferences, and pain points directly connected to the project. We seek available literature and related insights once we have a preliminary user profile. This may include reports, scientific publications, conference presentations, webinars or any content that someone else has previously analysed and published about our target user group.

These resources are often very valuable and, when evaluated for reliability, can replace certain research efforts (or narrow them down) or corroborate and enhance our understanding of the market's dynamics.

We delve into comprehensive user research, employing various methods (image by Midjourney).

2) Web analytics

We investigate the higher-level statistics to identify any overarching problems or anomalies. Once these are identified, we get into the details of the data. In other words, first, we focus on quantity methods (to learn what users are doing) and then gradually descend to more granular, qualitative methods (to learn why they are doing this). The key is not to get lost in the volume of data but to look at it with a clear goal in mind.

Web analytics can sometimes show us the way by preceding user research. This process should be viewed as dynamic, and the order can vary depending on the project and its specific requirements.

3) IDIs, surveys and group workshops

This is a crucial step during which we employ a range of methodologies to gain insights into users’ perspectives. The approach involves In-Depth Interviews (IDIs), surveys, and group workshops.

IDIs offer an opportunity to engage with users directly, delving into their perspectives, needs, and expectations. On the other hand, surveys provide a structured means to quantify various aspects, helping us understand user sentiments and preferences on a broader scale. We also arrange group workshops that serve as a unique space for collecting information from a larger group.

The precise order in which we employ these methods depends on the specific context of each project, but their synergy plays a pivotal role in developing client-centred solutions.

4) Ethnographic research

As we have written in this article, “What people say, what people do and what people say they do are entirely different things”. This is why we conduct ethnographic research – an in-depth study that often comes at a point when we need a holistic view of the user's behaviour to guide our design efforts.

It allows us to witness users in their natural environment and gain insights beyond what they declare in interviews. The method involves observing users as they go about their daily tasks, or “shadowing them”, and provides a unique window into their behaviours, motivations, and pain points. By quietly observing users, we can better understand their interactions with digital products and identify nuances that might remain hidden during traditional interviews or surveys.

The mix of qualitative and quantitative user research methods is an anchor for the later stages of the design process, where we aim to optimise the user experience. After the sessions, we often return to web analytics to juxtapose what we have heard and observed with data.

5) Analysis of user session recordings

After a global analysis of trends using quantitative methods and the identification of users’ personal motivations using qualitative methods, we re-examine how it works in combination by analysing the recordings of user sessions. This step confirms the previous observations and provides a holistic view of the product through the eyes of the users.

We immerse ourselves in user sessions, witnessing their every click, tap, and scroll, as well as the paths they follow, the features they use, and the issues they encounter. It's about getting up close and personal with the user experience, and it complements other methods like web analytics and ethnographic research.

Additionally, this step often bridges different phases of the discovery process, guiding us to the aspects that require deeper exploration. By leveraging session recordings, we corroborate or challenge the insights gained from interviews and surveys, ensuring our understanding of user behaviour is comprehensive and accurate.

6) Summary group workshops

These workshops are a finale of user research, combining various insights and knowledge gained from IDIs, surveys, ethnographic research, and session recording analysis. It’s an occasion to validate our findings and ensure alignment between our insights and the client's perspective.

Sometimes, we discover hidden or previously unconsidered processes that have emerged in the previous stages of the process. It also helps us to prioritise: By discussing the results, we can determine which topics resonate most strongly with respondents. On this basis, we know what is most important to them and what is less critical.

At the end, we combine various insights and knowledge gained from IDIs, surveys, ethnographic research, and session recording analysis (image by Midjourney)

Read also: How to build a knowledge system around a new tool?

Phase IV. Desk research

The final phase of our discovery process is desk research, which encompasses components such as competition research, UX and UI benchmarks, draft tests, and reassessing project risks. We do this as the last stage because only then do we know exactly what to look out for and can assess the competition's efforts in a particular area. In previous stages, some things might escape us or turn out to be something "ordinary." When the desk research is done at the end, it ensures we've gotten the most out of the project.

1) Competition research

Our objective here is to gain a comprehensive understanding of the competitive landscape. We scrutinise what other market players offer, considering both functional and aesthetic aspects.

What’s essential, though, is that competition serves as a reference point for users and is a valuable resource for understanding their habits and preferences that a skilled designer must account for.

We do not limit our analysis to direct competitors; for instance, when working with a window manufacturer, we also explore solutions created by companies involved in home furnishings, targeting a broader spectrum of consumers, architects, and specialist contractors. This holistic approach enables us to effectively identify and surpass the standards to meet user expectations.

2) UX benchmarks

In this step, we review existing products on the market to identify patterns and solutions that can inspire and inform our design process.

We focus not only on similar systems within the same industry but also on parallel processes. For example, when working on a benefits card management application, we also examine banking applications as they share common elements related to card management, with which users are often familiar. This broad perspective allows us to gain insight into effective practices and tareas that require improvement in user interactions and experiences, which enhances our design approach.

3) UI benchmarks

We focus on gathering examples that inspire our graphics, style, and overall aesthetics. We strive to establish a visual direction that aligns with our client's vision and resonates with their target audience. It ensures our designs are user-friendly and aesthetically appealing, creating a visually engaging product.

4) UI Draftest

In this stage, which we call “UI draftests”, we use a powerful tool similar to a survey in which our clients evaluate the creative concepts presented to them. This process serves as a compass that points them in the direction they are most comfortable with.

They evaluate such components as the first impression, layout, colour palettes, typography, composition, shapes, illustrations, photos and more. Later, those who participate in dratfest, will give their opinion on the graphic design.

This approach minimises the risk of rejection of the proposal and ensures that the design seamlessly aligns with client preferences and removes potential roadblocks, resulting in more cost-effective development and higher user satisfaction.

Extra point: Reassessing project risks

Last, revisiting and reassessing project risks is essential, considering all the insights and information gathered throughout the discovery process. It’s best done through open dialogue, as it helps us establish a risk management strategy that aligns with the project's current state and develops countermeasures.

Flexibility above all

While there is no universal order of activities, the framework we discussed serves as our standard. It provides a solid foundation and a structured approach to understanding user behaviour and product analysis. We recognise that there may be cases where a change in the order of tasks is necessary, but our main goal remains the same: We want to ensure that every crucial aspect is carefully considered. This commitment to comprehensive research and analysis enables us to deliver exceptional results that meet user needs and behaviour.